- The Social Security Code has fixed different thresholds with respect to eligibility for gratuity of permanent and fixed-term employees

- Gratuity shall be payable to eligible employees by every shop or establishment in which ten (10) or more employees are employed, or were employed, on any day of the preceding twelve (12) months

- Gratuity shall be payable to an employee on the termination of his employment after he has rendered continuous service for not less than five (5) years, on his superannuation; on his retirement or resignation; on his death or disablement due to accident or disease; on termination of his contract period under fixed-term employment. However, continuous service of five (5) years shall not be necessary where the termination of the employment of any employee is due to the expiration of fixed-term employment

- For every completed year of service or part thereof in excess of six (6) months, the employer shall pay gratuity to an employee at the rate of fifteen (15) days’ wages. The amount of gratuity payable to an employee shall not exceed such amount as may be notified by the Central Government. Gratuity under the SS Code is payable to employees hired directly or through a contractor

Penalty under social security code for default under the provisions of payment of Gratuity

If any person fails to pay any amount of gratuity to which an employee is entitled to, he shall be punishable with imprisonment for a term which may extend to one (1) year or with a fine which may extend to Rupees Fifty Thousand (Rs. 50,000/-), or with both.

Mr. Shivam Jha

(Industrial Relation Advisor and professional- HR Ignite)

Click here for New Labour Code Training Brochure

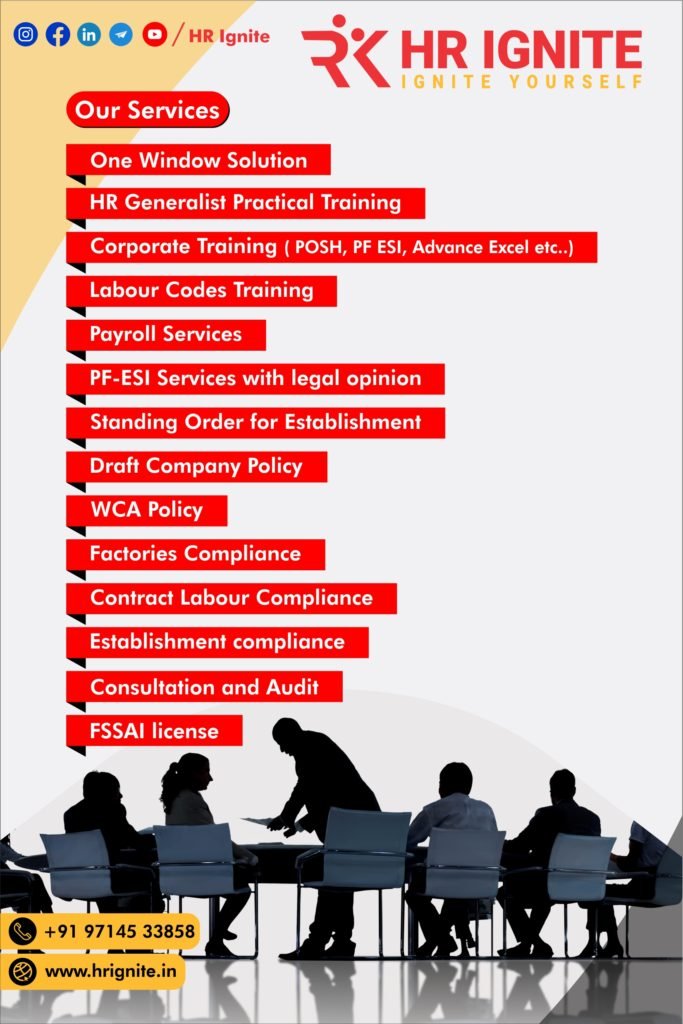

HR Ignite Services:-

- Click here for HR Generalist Practical Training- Online | Classroom

- Click here for New Labour Codes Training With Leading Case Studies | Practical Training on 44+ Act

- Click here for Advance Excel Course- Online | Classroom

- Free HR Job Portal for HR Hiring | HR Vacancy

- Corporate Training

Join the below links to get free labor law updates & HR Jobs:

- WhatsApp Groups:HR Ignite-1 | HR Ignite-2 | HR Ignite-3 | HR Ignite-4 | HR Ignite-5 | HR Ignite-6

Inquiry Form

#EPF #HR Ignite advance excel training applicability Apprentice Act best hr training code on industrial relations code on occupational safety code on OSHW code on social security code on wages core hr training corporate training epfo epf update esi esic hr HR Certification course hr course HR Executive hr generalist practical training hr generalist training hrignite hr ignite hr ignite services hr jobs hr manager hr practical training HR training hr update HR Webinar HR whatsapp group industrial relations labor law training labour code training labour law training labour law update maternity benefit new labour code training payment of wages POSH Act registration Sexual harassment of women at workplace whatsapp group

Training Inquiry Form: