many HR confused about when the employer is liable to pay the bonus according to the new code on wages 2019, so here we discussed it.

Newly set up establishment:

Generally, newly set establishment faced a newly harder and challenges for making a profit, and for newly set up establishment profit-making is like a-

Drag out a Bottle from Dig

So, for the motive to give relaxation a deterrent provision in code of wages 2019

I.e exemption in payment of Bonus for newly set up establishment but subject to the condition

In a newly set up establishment, the bonus shall be paid as under:

- In first 5 Accounting years – in which the employer sells the goods produced or manufactured by Him or renders services, a bonus shall be payable only in respect of the accounting years in which the employer deprives profit of such establishment, No set-off and set on is allowable

- For 6th Accounting years – set-on it set-off in respect of the 5th and 6th Accounting years

- For 7th Accounting years – set on and set off in respect of 5,6,7th Accounting years

- For 8th Accounting years – from the right accounting years the provision of set-on and set-off shall apply in relation to such establishment as they apply in relation to any other establishment

Note:

An establishment shall not be deemed to be newly set up simply by reason of a change I. It’s location management, name or ownership

Shivam Jha

HR Ignite

(Industrial relation Advisor and professional)

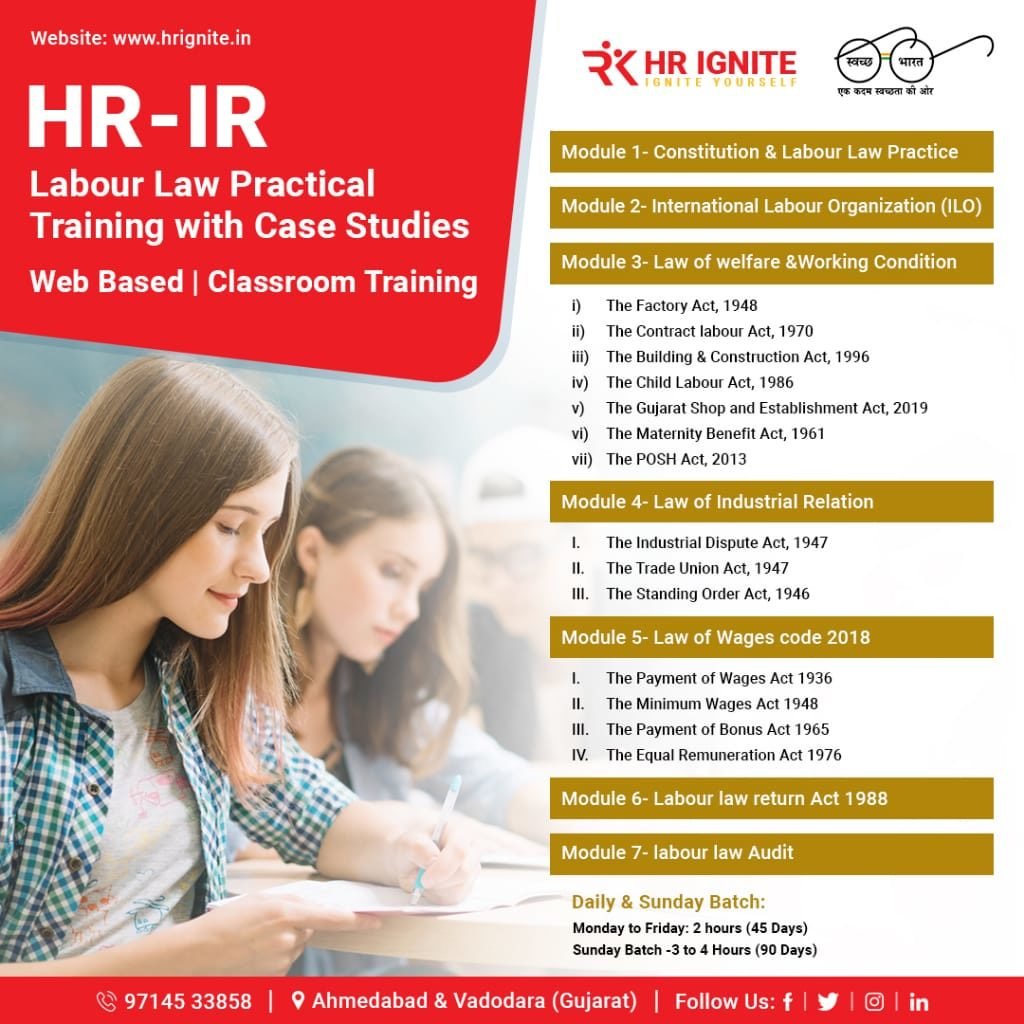

HR Ignite Services:-

- HR Generalist Practical Training- Online | Classroom

- HR Labour Law Practical Training with Case Studies – Online | Classroom

- Free HR Job Portal for HR Hiring | HR Vacancy

- Advance Excel Course- Online | Classroom

Click on the link to Join Our WhatsApp Groups for HR-IR updates & Jobs:

-The Moment you think you are out of Resources; you still have one thing, Will to Win.Ignite it