As per the Gratuity Act, employer who employs ten or more than ten employees on any day of proceeding one year need to pay gratuity to his employees. The employees or workers employed in every shop, educational institution, establishment and factory; irrespective of salary, status and post are eligible for gratuity on completion of five years of service.

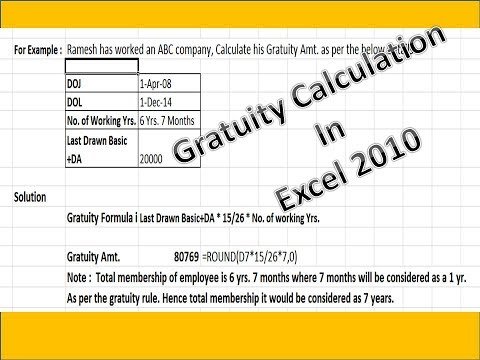

- Monthly Salaried Employee

Gratuity = Last drawn wages × 15/26 × Completed years of Service

Note:

Wages = Last Drawn

Month = Period of 26 Days

15 days wages = Last drawn wages × 15/26

Piece Rated Employee

Gratuity = Last drawn wages × 15/26 × Completed years of Service (including a part of year in excess of six months)

Note:

Last drawn Wages = Total wages received during three months immediately preceding termination /Days actually worked

Last drawn wages shall not include overtime wages.

- Employee of a Seasonal Establishment.

Employee of seasonal establishment shall be paid gratuity at the rate of 7 days wages for each season.

- If in case employee is not in continuous service of one year, he/she shall be deemed to be in continuous service of one year if; he/she has, immediately preceding twelve colander months, worked under the employer for not less than –

- 190 Days (in case of employee employed in mines below ground)

- 190 Days (in case if employee employed in an establishment which works for less than six days in a week)

- 240 Days ( in any other case)

- If

in case employee is not in continuous service of six months, he/she shall

be deemed to be in continuous service of six months if; he/she has,

immediately preceding six colander months, worked under the employer for

not less than –

- 95 Days (in case of employee employed in mines below ground)

- 95 Days (in case if employee employed in an establishment which works for less than six days in a week)

- 120 Days ( in any other case)

An employer may offer gratuity to his/her employees from his/her own pocket or may take a group gratuity plan with an insurance provider. Annual contributions are then paid by the employer to the insurance provider for this. The employee too can contribute to his/her gratuity amount. The gratuity paid by the insurance company is based on the clauses in the group insurance scheme.

- To get all HR updates Join with us:

- HR Whatsapp Group

- HR Updates LinkedIn Page

- HR Ignite Facebook Page

- Telegram Channel

- HR Practical Training