- The govt of India has taken a historic decision to scale back the speed of contribution under the ESI Act

- The govt has reduced contributions of employee and employer towards ESIC to 4% from prevailing 6.5%

- Currently, the employee’s contribution rate is 0.75% of the wages and employer’s is 3.25% of the wages payable in respect of the workers in every wage period that is from 1st July 2019

- The wage maximum of coverage was enhanced from Rs 15,000 per month to Rs 21,000 per month from January 1, 2017

ESI Cash Welfare

Medical Benefits:

There are following 3 types of Medical Benefits:

| Type |

Nature of Problems | Provided At |

| PRIMARY | BASIC AILMENTS | ESIS DISPENSARY/ INSURED MEDICAL PRACTITIONERS |

| SECONDARY | BASIC HOSPITALIZATION, INCLUDING SURGERIES | GIVEN AT ESIC HOSPITAL |

| TERTIARY (SST) | HIGHER TREATMENT/SURGERIES | AT ESIC HOSPITALS/ PRIVATE TIE UP HOSPITALS |

Sickness Benefit:

| NAME OF BENEFITS |

CONTRIBUTORY CONDITION | DURATION | RATE |

| SICKNESS | 78 days Contribution to be paid relevant CP | Up to 91 days in 2 consecutive Benefit period | 70 % of average wages |

| ENHANCED SB | Same As Above | 07 Days for Men , 14 days for Women | 100 % wages |

| EXTENDED SB | For 34 specified long term disease 2 year Continuous Employment and 156 days Contribution in 2 CP | Maximum up to 730 days. | 80% of wages |

Dependent Benefit:

| NAME OF BENEFITS | CONTRIBUTORY CONDITION | DURATION | RATE |

| DEPENDENT BENEFIT | Day 1 of Insurable Employment for employment Injury cases | For Widows whole life or re-marriage. Son up to age of 25 years Daughter till marriage Widowed mother dependent whole life | 90 % of wages subject to the defined ratio of dependents. |

| EXTENDED SB | For 34 specified long term disease 2 year Continuous Employment and 156 days Contribution in 4 CP | Maximum up to 730 days. | 80 % of wages |

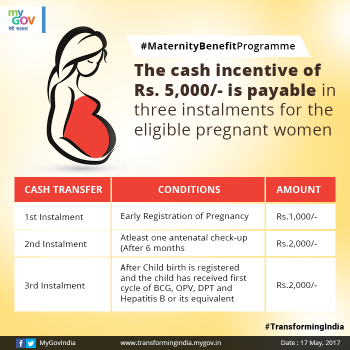

Maternity Benefit:

| NAME OF BENEFITS | CONTRIBUTORY CONDITION | DURATION | RATE |

| Maternity Benefit | 70 days contributions to be paid by the insured women in 2 previous contribution periods | Up to 26 weeks 1 month more for sickness arising out of pregnancy duly certified by the doctor | 100 % of wages |

Disablement Benefits:

| NAME OF BENEFITS | CONTRIBUTORY CONDITION | DURATION | RATE |

| Temporary Disablement | Day 1 of Insurable Employment for employment Injury cases | As long as Temporary disablement last | 90% of last wages |

| Permanent Disablement | Day 1 of Insurable Employment for employment Injury cases | For Whole Life | As per loss of Earning Capacity calculated by Medical Board |

Other Benefits:

| NAME OF BENEFITS | CONTRIBUTORY CONDITION | DURATION | RATE |

Confinement Expenses Confinement Expenses | IW/Wife of IP is eligible if confinement takes place at location where ESI Hospital is not available | For 2 confinement only | Rs. 10000/- per case |

| Funeral Expenses | From Day 1 of Insurable employment | For funeral expenses on death of IP | Maximum of Rs.15000/- |

click on link to get Official Gov. Gazette

click on link to get Official Gov. Gazette

- Contribution rate

- Action on outsourcing Contractors in case of Default

- Income limit of dependents parents from 5k to 9k

- Registration of Employee within 10 days of Date of Joining

-The Moment you think you are out of Resources; you still have one thing, Will to Win Ignite it

- HR Generalist Practical Training

- Labor Law Training

- PoSH Training

- Advance Excel Training

- Corporate Training ( PoSH, Awareness Program, Soft Skill Training, HR Training, etc…)

- PF-ESI Registration

- Payroll Training