Documents

Required During Hiring A New Contractor

1. Registration Certificate under Shops & Commercial Establishments Act.

2. Rent Deed in case, office is rented.

3. Registration certificate of EPF

4. Registration certificate of ESI.

5. Registration certificate of Service Tax.

6. Pan card of the Company or Proprietor in case of individual.

7. Address proof, ID proof of the contractor (Proprietor)

8. Labour License under Contract Labour Act.

9. Undertaking for Compliance.

10. Indemnity Bond – Duly signed, stamped & notarized on Rs. 100/- stamp

paper.

Documents required for New Contract License: (By Contractor)

1. Application for License in Form IV (triple copy).

2. Principle Employer’s certificate in Form V

3. Registration Certificate of the company (Principle Employer)

4. Annexure of manpower of the company (Principle Employer)

5. Employee Details (ID No. name, address, DOJ, DOB) in Form XIII (13)

6. Copy of original agreement.

7. Registration Certificate under Shops & Commercial Establishments Act.

(Contractor)

8. Pan card of the Company or Proprietor incase of individual

9. Registration certificate of EPF (Contractor)

10. Registration certificate of ESI. (Contractor)

11. Original challan of Rs. ______/- of treasury to Bank. (Contractor)

Documents

required for Renewal of Contract License: (By Contractor)

1. Principle Employer’s certificate in Form V

2. Annexure of manpower of the company (Principle Employer)

3. Registration Certificate of the company (Principle Employer)

4. Employee Details (ID no, name, address, DOJ, DOB) in Form XIII (13)

5. Half Yearly Return by Principle employer in Form XXIV(24)

6. Application for renewal of license in Form VII (7)

7. Paid Bonus Register in Form D

8. Wage Register (Last 3 months at least) Form XVII (17)

9. Photocopy Agreement

10. Registration Certificate under Shops & Commercial Establishments Act.

(Contractor)

11. Pan card of the Company or Proprietor incase of individual

12. Registration certificate of EPF (Contractor)

13. Registration certificate of ESI. (Contractor)

14. Original treasury challan of Rs.______/- (Contractor)

Documents

to be maintained by contractor under the Contract Labour Act

1. Contract License

2. Muster Roll/Attendance register

3. Register of Fine, Deduction , Advances

4. Wage Register

5. Leave with wages register

6. Register of SL/CL & National Holidays

7. Overtime register

8. Wages Slips

9. Employment Card

10. Bonus Register

11. Record under EPF Act (Register, Challan, Returns, Inspection Book etc)

12. Register of ESI Act (Register, Challan, Returns, Inspection Book, Accident

Book etc.)

13. Labour Welfare returns

14. Returns of Contract Labour in Form XXIV(24)

Documents to be maintained by Principal Employer under the Contract Labour Act

1. Contract Labour License

2. Annexure of Manpower

3. Register of Contractors

4. Yearly Returns of Contract Labour in Form XXV(24)

5. Form V issued to contractors

CHECK LIST

FOR PRINCIPAL EMPLOYERS ENGAGING

Contract labour through contractor and Contractor Performance Review

1). First of all, it must be ensured that there is no notification prohibition contract labour system by the appropriate government for the employment of contract in any process, operation or any work of the establishment. Like in Madhya Pradesh Employment of contract, labour in automobile industries is prohibited.

2). Before identifying a contractor, it is desirable to advertise in classified column (which will be economical) in the local newspaper inviting offers from the contractors and a copy of newspaper along with the invoice be preserved.

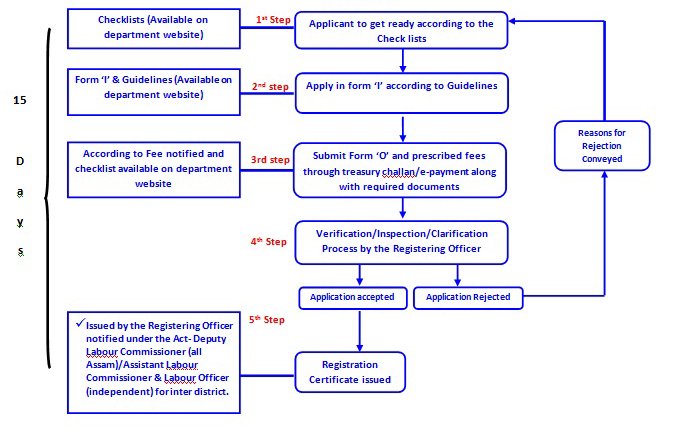

3). The principal employer is required to obtain registration under section 7 of the Contract Labour (R&A) Act in Form No.1 (in triplicate) to the Registering Officer of the area in which the establishment sought to be registered is located. The said Form shall be accompanied by demand draft showing the payment of fees for payment of registration.

4). Only those contractors be identified who have their own independent code number under the Employees’ Provident Funds & MP Act and the ESI Act. In case a contractor does not have independent codes for ESI and Employees’ Provident Fund, an undertaking be taken that his employees be covered by the principal employer and he will reimburse the amount of contributions.

5). Whenever a contractor will be having 20 or more persons working for him, it is obligatory that licence be taken under the Act. Accordingly, the principal employer will issue Form-V (Form of certificate by the principal employer) to the contractor for obtaining licence. The principal employer will ensure that the contractor is also renewing his licence every year.

6). The principal employer should ensure that if the contract labours are employed for same or similar kind of work as the regular employee of the Principal Employer does, then the wage rates and other conditions of service should be the same for the contract labour as applicable to the regular employee.

7). The Principal Employer must ensure that it issues certificate in Form V to the contractor for obtaining licence as provided as provided under section 12 of the Act.

8). The Principal Employer should not involve himself in selection process of contract labour otherwise it may lead to sham and camouflage.

9). Principal Employer should not supervise the activity of contract labour because it may amount to sham and camouflage and, in turn, the contact labour would be declared employees of the Principal Employer. In such a scenario, the Industrial Court has the power to direct Principal Employer to absorb the contract labour.

10). That the Principal Employer gets the registration certificate and the contractor obtains the licence from the competent authority as provided under section 7 of the Act before proceedings to engage the contract labour.

11). The payment of wages to the employees, employed by the contractor, is disbursed to his employees by the contractor himself or this nominee and Principal Employer has to depute his representative to be present and sign the payment register in token of having disbursed the salary in his presence by the contractor.

12). Among other employees, as provided by the contractor, there must be at least one supervisor through whom the officials of the Principal Employer could communicate, preference be given to a contractor who has such type of work at other locations also.

13). Discipline of the employees of the contractor in the discharge of duties must be regulated by the contractor and not by the Principle Employer.

14). Leave to the employees of the contractor must be sanctioned by the contractor and not by the Principal Employer.

15). No advance should be paid by the Principle Employer to the contractor’s employees directly. Only contractor must regulate the same.

16). Maintenance of all types of record in respect of the employees employed by the contractor should be his own responsibility and Principal Employer should not intervene in such matters.

17). If the Principal Employer is covered by the Employee’s Provident Funds and Miscellaneous Provisions Act and the Employee’s State Insurance Act, then preference should be given to those contractors who have their own code numbers under these Acts.

18). The Principal Employer must ensure compliance of the obligation pertaining to the various provisions regarding amenities and benefits as prescribed under the Act.

19). The Principal Employer must ensure the submission of annual return to the prescribed authority in the prescribed form under the Act.

20). Experience certificates should not be issued by the Principal Employer to the employees of the contractor.

21). No performance appraisal of any sort shall be made by Principal Employer to the employees of the contractor.

22). Principal Employer should EPF & ESI latest notification: satellite: avoid any settlement process, either bi-partite or tri-partite.

23). Contractor should prepare and hand over the pass book to the inter-state migrant employees under the Inter –State migrant employees under the Inter State Workers Migrant Act, 1976.

24). Avoid engagement of on-roll and off-roll employees in same or similar job.

25). License should be displayed at the work-place.

26). Principle Employer must send annual return by 15th February every year.

27). Principal Employer should see that the contract labour should not work in Principal Employer’s establishment after termination of contract.

28). The colour of the uniforms of the contract labour should be different than that of the employees of the Principal Employer.

29). Canteen facilities, if being provided by the Principal Employer to its employees, the contract labour should be charged at little higher rate if it is decided they can also avail such facility.

30). The Principal Employer should get an undertaking in the following of each month from the contractor that not only the wages have been paid to its employees but also they have been paid to its employees but also they have been enrolled under ESI and Employees Provident Funds & MP Act and the contractor has paid their contributions (with the proof of deposit). Should there be any reason, the Principal Employer is held liable to discharge any such monitory obligation, the contractor will be responsible and that amount can be deducted from his dues as payable by the Principal Employer. A pro-forma to this effect is given as Appendix A.